Economic/Financial Results

In 2015, HISPASAT continued to carry out its activities in the framework set forth by the main strategic lines that focus on growth. In this line, considerable work has been done to enter into new markets such as Morocco, establish partnerships with other operators, and renew and extend contracts with important clients, especially those in Latin American countries such as Brazil, Peru, Mexico and Colombia.

The commercial efforts made have also led to the consolidation of significant backlog (guaranteed long-term satellite capacity contracts), which reached a figure equivalent to seven times the company’s annual revenue at the end of the financial year.

OPERATING REVENUE

In 2015, total revenue earned reached 219.6 million euros, which amounts to an increase of 8.7% with respect to the previous year.

It is worth nothing that HISPASAT has benefited from the positive effect of the exchange rate, favoured by the strength of the dollar, which has offset the sharp depreciation of the Brazilian real.

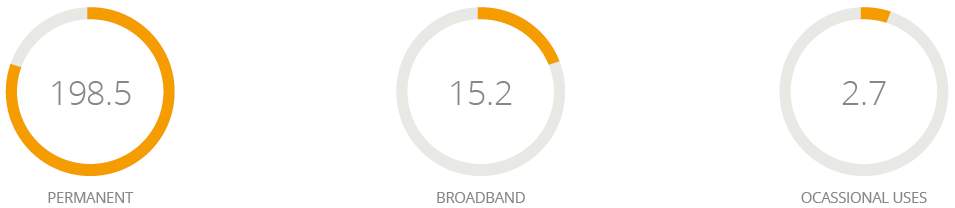

216.4 million euros of the total revenue came from leasing space capacity, 9.72% more with respect to the previous year.

REVENUE FROM SPACE CAPACITY

BREAKDOWN BY GEOGRAPHIC AREA (in millions of euros)

By geographic area, 33.64% (72.8 million euros) of total revenue from leasing Group space capacity came from Europe, while 65.4% (141.5 million euros) came from the North and South American market. The remaining 0.96% (2.1 million euros) came from other regions.

HISPASAT 2015

EVOLUTION OF OPERATING AND EBITDA EXPENSES

Operating expenses for 2015 came to 40.6 million euros.

During the 2015 business year, HISPASAT continued to focus on activities aimed at adapting the operational structure and its costs to the needs of new satellite projects. These policies are aimed at making HISPASAT more competitive in Europe, the Americas, and other strategic regions in the near future.

Out of the evolution described in the previous sections, at the end of 2015 the EBITDA were 178.9 million euros, which represents an operating margin of 81.5%, a figure that once again establishes HISPASAT’s position as one of the most profitable and efficient companies in the satellite sector.

EVOLUTION OF RESULTS

By the end of the 2015 business year, HISPASAT had obtained a consolidated operating profit of 92.4 million euros.

Taking into account the result given by the equity method for the company’s share in HISDESAT, the consolidated financial result was (13.1) million euros.

After the financial result and the results of associated companies consolidated by the equity method, the consolidated pre-tax result reached 79.3 million euros. Likewise, in the 2015 business year, HISPASAT registered a net profit at the parent company of 62.6 million euros, 37.22% higher than the 45.6 million euros obtained at the end of the previous business year.

DIVIDEND

On 3 February 2016, the Board of Directors formulated the consolidated annual accounts for the Group, and the individual accounts for HISPASAT, S.A. They include a proposal for dividend distribution of 12.5 million euros, awaiting approval at the Annual General Shareholders’ Meeting.

FINANCIAL STRUCTURE AND CASH FLOW

As of 31 December 2015, bank debt had increased to 367.3 million euros.

Operating cash flow generated by HISPASAT in 2015 reached 153.7 million euros, mainly used to finance the Group’s investment activities.

Cash flow from fixed asset investments (tangible and intangible) increased to 218.5 million euros, mainly from payments from investments associated with the Amazonas 5, Hispasat 30W-6 (Hispasat 1F) and Hispasat 36W-1 (Hispasat AG1) projects, and with Intelsat for the commercialisation of the Hispasat 55W-2 (Intelsat 34) satellite.

In the area of cash flow from financial activities, it is worth mentioning that 90.7 million euros of bank debt reached maturity, while 123.4 million euros were made available for new financing.

Investment

Investments in tangible and intangible fixed assets increased to 245.1 million euros in comparison to 156.6 million euros from the 2014 business year, maintaining the strong investment rate of the previous business years.

The Hispasat 36W-1 (Hispasat AG1) programme continued in 2015, as well as the two satellite projects – Amazonas 5 and Hispasat 30W-6 (Hispasat 1F) – which began in the previous business year.

During the 2015 business year, HISPASAT was involved in different R&D initiatives that promoted the development of new solutions and services in the field of satellite communications. This once again reflects the innovative spirit of the company and its commitment to quality and excellence.