Anabel Segura, 11

28108 Alcobendas / Madrid

España / +34 91 710 25 40

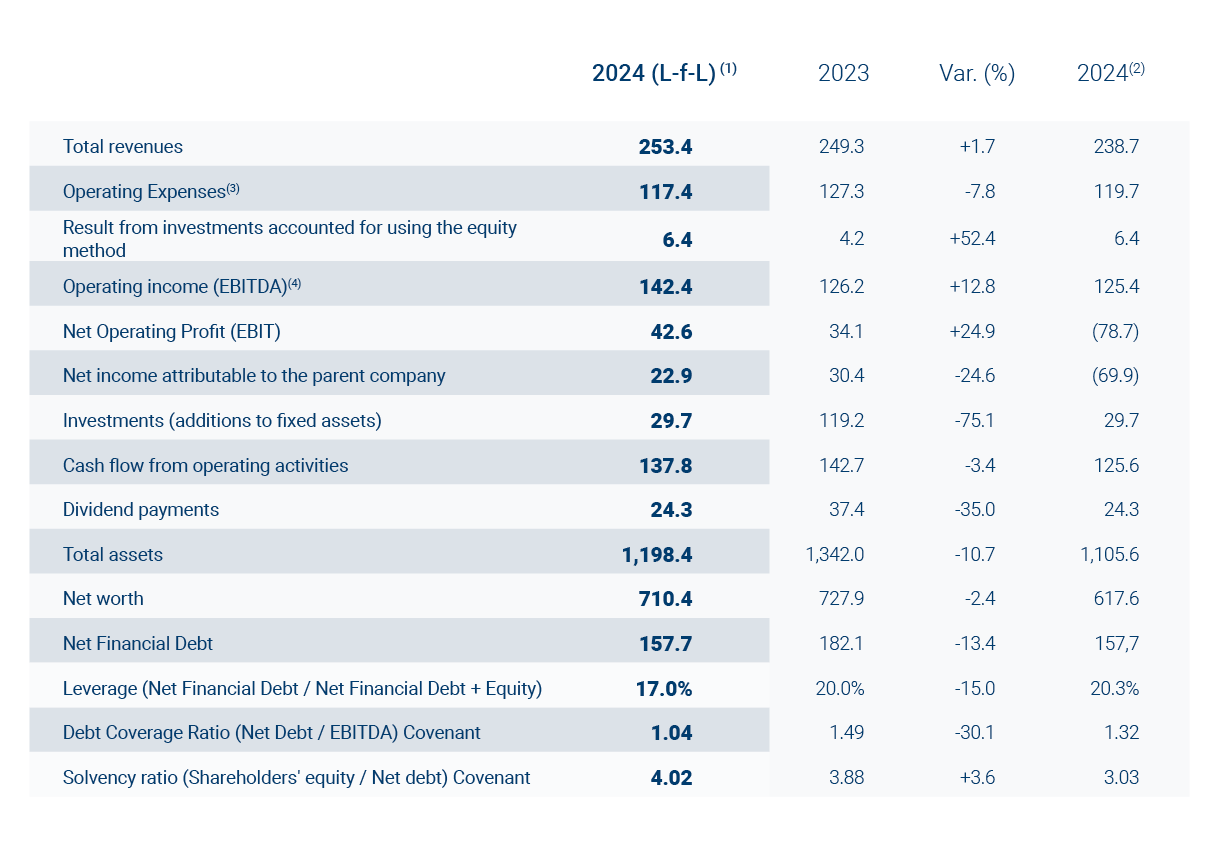

Key figures

(millions of euros)

(1) L-f-L (Like-for-Like – homogeneous comparable with 2023).

(2) Audited financial statements 2024.

(3) Operating expenses include supplies, personnel expenses and other operating expenses in the income statement.

(4) Calculated as the operating income of the income statement less depreciation and amortization and valuation adjustments. Includes the result of investments accounted for using the equity method (with activity similar to that of the Group).

Economic and financial results

The aerospace industry is going through a disruptive period. The emergence of new competitors who have integrated the entire satellite value chain (manufacturing, launch and operation) is leading to a transformation of the traditional activity.

The entry of these new competitors from other sectors, the expansion of the capacity offer (GEO and non-GEO) and new customer needs are creating a new and complex environment.

Despite the demands of this new competitive context, Hispasat has managed to close the year with economic-financial figures that, in comparable terms with 2023, show the resilience of its management model and the strength of its balance sheet.

In this scenario of transformation of the sector, the accounting results for the year 2024 include the effects caused by some relevant customers in the telco segment, which have taken advantage of the bankruptcy regulation for financial restructuring. To this must be added the revision made by Hispasat of the valuation of its non-financial assets , in order to adapt their accounting reflection to the situation of the sector. All this has had an impact on the Group’s negative result of 92.8 million euros (net of the tax effect). This adjustment in the valuation of the assets will have a positive impact on Hispasat’s results in the coming years.

Discounting the adjustments caused by the impact of these extraordinary circumstances, exogenous to the company’s management, the operating result, in comparable terms with the previous year, would reach 42.6 million euros (+25% with respect to 2023).

The accounting result attributed to the Group’s parent company reflects an exercise in transparency, responsibility and rigor to bring the company’s balance sheet into line with the reality of the environment. Despite this, the company has a well-defined purpose, continues to generate recurring cash flow well above its annual debt maturities, has a solid portfolio of contracts that ensure a substantial part of its future revenues and has sufficient financial strength to continue to be a relevant player in the sector

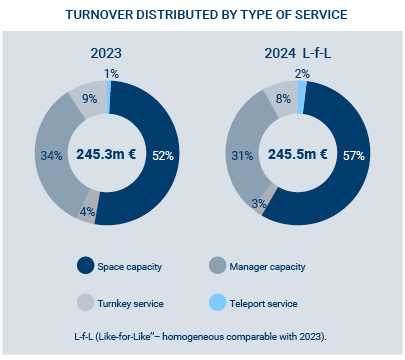

Operating revenues

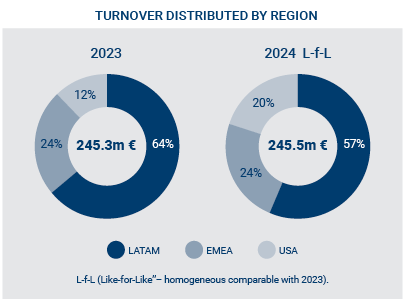

In 2024, the Group’s total operating revenues reached, on a like-for-like basis with last year, €253.4 million, reflecting growth of +1.7% in a context of increased competition and technological disruption.

After adjusting for the effect of the insolvency proceedings filed by some of the Group’s significant customers in the telco segment, book revenues totaled 238.7 million euros.

In 2024, Hispasat has continued to make progress in the transformation of its business by reinforcing its dual role as a wholesale space capacity provider and as a value added service provider.

INCOME BY REGION

INCOME BY BUSINESS MODEL

Operating expenses

In view of the complexity of the new dynamics of the sector, the company intensified its policies and processes aimed at maximizing the efficiency of its operations, also promoting an operating expense adjustment plan and implementing a new purchasing model.

This plan entails a comprehensive transformation of the function, based on four fundamental principles that guide the Group’s procurement management of goods and services: it combines the generation of savings through open bidding processes and fosters competition, with agile and business-oriented internal processes, while at the same time being rigorous in complying with internal control processes.

Overall, and excluding personnel expenses, an efficiency plan was implemented, which identified operational optimizations and additional synergies in maximizing the use of the Group’s satellite fleet for the retail business. As a result of this plan, aggregate savings of more than 12.5% were achieved, despite the fact that the insurance item experienced an increase of almost 69% (3.4 million euros), due to the insurance coverage taken out for the new Amazonas Nexus satellite (in 2023, insured by the launch policy), as well as the unfavorable context of the insurance market in general and the space segment in particular.

Consolidated operating expenses amounted to €117.4 million in 2024 on a like-for-like basis, representing an overall year-on-year decrease of 7.8%.

Recorded book operating expenses amounted to EUR 119.7 million. This figure includes the effect of an accounting reclassification amounting to EUR 2.3 million between trade provisions and provision for financial receivables, adjusted for comparable pro forma purposes.

GASTOS OPERATIVOS

At the same time, all Group companies redoubled their efforts to improve their collection processes. As a result of this process, provisions were reversed, resulting in both the reversal of provisions set aside for bad debt risks in previous years and the reduction of trade receivables balances by €14.6 million (€42.7 million at the end of 2024 compared with €56.3 million at December 31, 2023).

All this was accompanied by a significant evolution in customer aging, which improved the proportion of overdue balances by 9 percentage points.

TRADE RECEIVABLES

Operating income (EBITDA) and operating income (EBIT)

The result of companies accounted for using the equity method amounted to EUR 6.5 million (EUR 4.2 million in 2023). Of this amount, 6.4 million euros correspond to activities analogous to the activity of the Hispasat Group and, consequently, contribute to the operating result (EBITDA). The remaining 0.1 million euros correspond to activities other than the services provided by the Group, excluded from EBITDA.

RESULT OF COMPANIES CONSOLIDATED BY THE EQUITY METHOD

From the aggregation of the aforementioned items, the resulting consolidated EBITDA at the end of 2024, adjusted for extraordinary effects exogenous to the company’s management, amounts to 142.4 million euros. This represents an operating margin on revenues of 56.2% and is 12.8% higher than in 2023. In nominal terms, EBITDA amounted to EUR 125.4 million.

EBITDA

Consistent with the development of the operating result (EBITDA), the operating result (comparable pro forma) also advanced to 42.6 million euros, increasing by 8.5 million euros (+25%) compared to the 34.1 million euros achieved in the previous year.

EBIT

The revision carried out by Hispasat of the valuation of its non-financial assets, aimed at adapting their accounting reflection to the situation of the sector and to the updated market evolution forecasts; together with the re-estimation of the useful life of the remote equipment of the services business, which will generate a reduction in depreciations, will have a positive impact on Hispasat’s results in the coming years.

Financial Result

The consolidated negative financial result amounted to 16.3 million euros, an increase of 7.2 million euros compared to the previous year. This is mainly due to the effect of the negative change in exchange rate differences of 4.4 million euros compared to the 2023 financial year. This is due to the effect of the capitalization of financial expenses of 2.4 million euros recorded in 2023 (which ended after the Amazonas Nexus satellite was put into commercial operation in the middle of last year) and the reclassification as a financial receivable of a trade receivable provided for 2023. This reclassification was in accordance with the restructuring plan agreed by the creditors’ meeting in the context of the bankruptcy proceedings in which the counterparty is involved. This has resulted in a higher financial expense of 1.6 million euros.

This set of effects penalizing the financial result was partially offset by 1.2 million euros, thanks to higher financial income obtained from remuneration of the liquidity available throughout the year, as well as savings generated by interest on financial debt as a result of lower average indebtedness compared with the previous year.

Investments

Investments in property, plant and equipment and intangible assets made by the Group in 2024, excluding the accounting effect of the application of IFRS-16, totaled 23.9 million euros, which, on a like-for-like basis compared with last year, would be slightly lower, less the investments corresponding to the last milestones of the Amazonas Nexus program, launched at the beginning of 2023.

The operational investment items undertaken during 2024 were mainly for monitoring and broadband systems. These initiatives correspond to the systems plan that the company has been undertaking to modernize and digitize its commercial, operational and business processes. As well as various actions to improve or expand the infrastructures that make up the ground segment.

Long-term leases classified as investments in accordance with IFRS 16 correspond mainly to leases of satellite capacity and housing sites where the technical equipment of the ground segment for the provision of satellite services is located. The Group allocated 5.8 million euros to these items in 2024.

Cash flows and debt

Cash flows

Cash flows from operating activities generated by the Hispasat Group in 2024 reached, in comparable homogeneous terms, 137.8 million euros (-3.4% compared to 2023). Taking into account the effect on this line of customers who filed for bankruptcy and financial restructuring proceedings in 2024, the cash flows from operating activities would amount to 125.6 million euros.

As regards financing cash flows, in 2024, structured bank debt maturities of 51 million euros and 46 million euros corresponding to repayments during the year of the credit lines available to the Group were met. Also, during 2024, drawdowns of credit lines in the amount of 32 million euros were made.

In addition, financing cash flow also includes payments for leases qualifying under IFRS-16 totaling EUR 22.2 million and the payment to the Group’s shareholders of the dividend for 2023 in the amount of EUR 24.3 million.

Net financial debt

The book value of bank debt at December 31, 2024 was EUR 200.4 million, down 23% on the previous year.

Net indebtedness at year-end, including guarantees given to third parties, was €157.7 million, decreasing from €182.1 million at year-end 2023 (-13%). The leverage ratio at December 31, 2024 stood at 20.3%.

The average interest rate on euro structured debt in 2024 (considering the commissions paid at the time of formalization) was 1.74%. The average interest rate on US dollar structured debt (excluding the revolving credit facility) was 2.82%.

Most of the Group’s financial debt is at fixed interest rates (99.7%), including the effect of interest rate hedging derivatives. The remaining 0.3% is contracted at variable interest rates.

With respect to the capital structure, the Group follows a policy of ensuring a financial structure that optimizes the cost of capital with a solid financial position, making the creation of value for the shareholder compatible with the achievement of a competitive cost for financing needs. The capital structure is monitored periodically, based on the leverage ratio. This ratio is calculated as Balance Sheet Net Financial Debt divided by Net Equity plus Net Financial Debt.

Liquidity and capital resources

The Group maintains a liquidity policy that ensures compliance with the payment commitments acquired, diversifying the coverage of financing needs and debt maturities.

The Group’s liquidity position is based fundamentally on the sustained generation of cash flows from its operations, with a relevant portfolio of contracts that guarantee a significant part of the revenues of future years. This, together with the existing financial capacity thanks to the availability of both short and long-term credit lines, allows for prudent liquidity risk management.

The average term to maturity of outstanding structured bank debt at year-end was 5.7 years.

The Group continues to have a solid liquidity position to continue to meet its operating cash requirements and debt maturities in the coming years.

At December 31, 2024, the liquidity position amounted to EUR 315.5 million: EUR 72.2 million of cash on hand, excluding the cash position corresponding to the funds from the subsidy to retail operators from the UNICO Rural Demand project in the amount of EUR 30.5 million, and EUR 243.3 million of undrawn credit lines.