KEY DATA

| 2019 | NOTES | |

| Total income | €174,9 M | -7,1% L-f-L(1) |

| Gross Operating Profit (EBITDA) | €129,5 M | -10,6% L-f-L(1) |

| EBITDA Margin | 74,1% | 77,4%(2) |

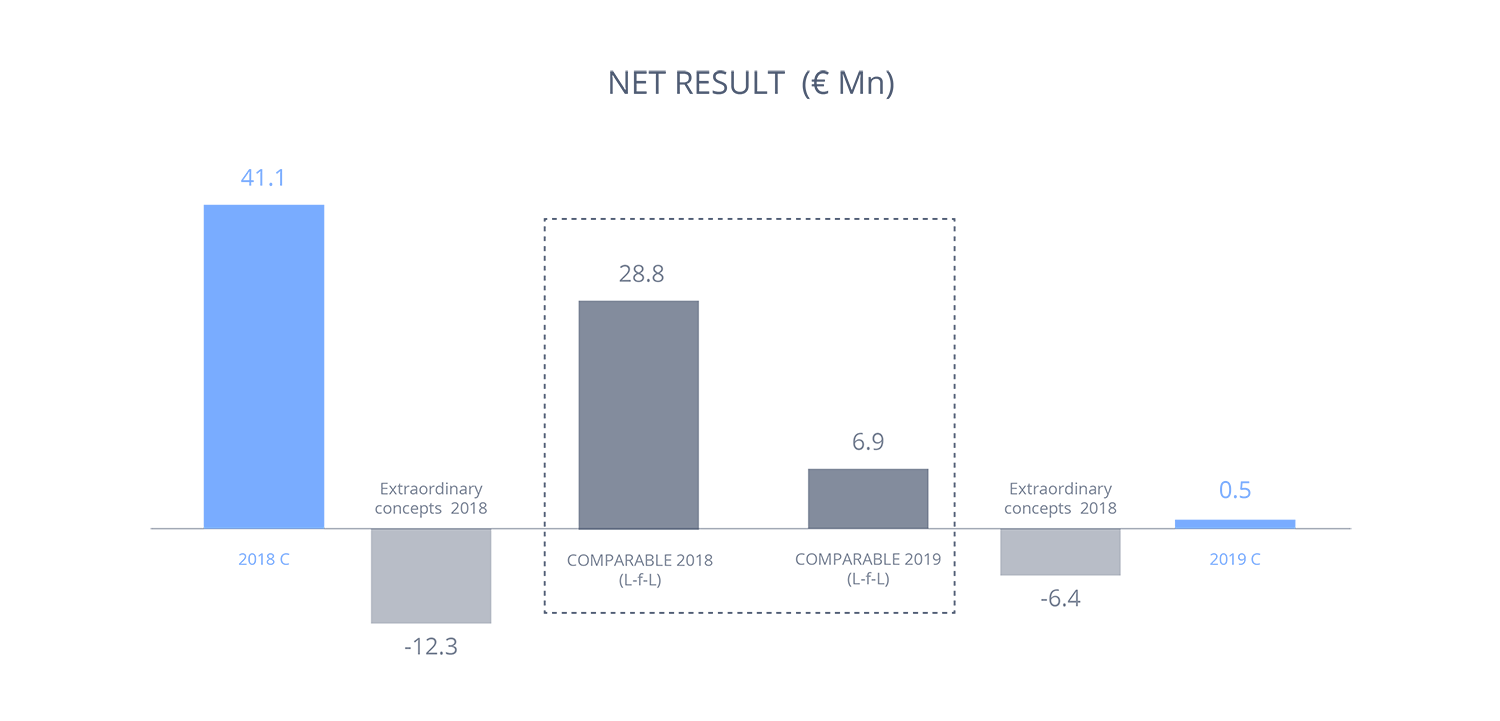

| Consolidated net profit attributed to the parent company | €0,5 M | €6,9 M (2) |

| Gross Cash Flow | €121,9 M | (3) |

| Payment of dividends | €41,1 M | 2018 financial year |

| Net worth (PN) | €776,0 M | |

| Leverage (DFN/DFN+PN) | 26,0% | |

| Investments | €43,7 M | |

| Total assets | €1,168.2 M | |

| Net Debt (DFN) | €273,8 M | |

| Debt coverage ratio (DFN/EBITDA) Convenant | 2,11 times |

(1) (L-f-L: “Like for Like”: Comparable evolution 2018-2019)

(2) (Excluding extraordinary effects)

(3) (Cash Flow from Operations before interest and taxes + Divestment of fixed assets)

ECONOMIC-FINANCIAL RESULTS

OPERATING REVENUE: BUSINESS CONTEXT IN THE 2019 FINANCIAL YEAR

The satellite sector continues to undergo a profound transformation in terms of its business model, which is basically characterised by the stagnation of its traditional activity, based on long-term leasing of space capacity and highly dependent on video, DTH and distribution services.

The rapid change in the patterns of use of telecommunications services, now more oriented to connectivity for content consumption and Internet access, and the deployment of high-capacity terrestrial solutions have led to a progressive and accelerated deterioration in demand for video satellite services. This has caused a strong imbalance between supply and demand that has been transferred, on the one hand, to capacity prices, with decreases in recent years of between 40 and 60% depending on the different verticals, and, on the other hand, to the duration of contracts, which are now much shorter.

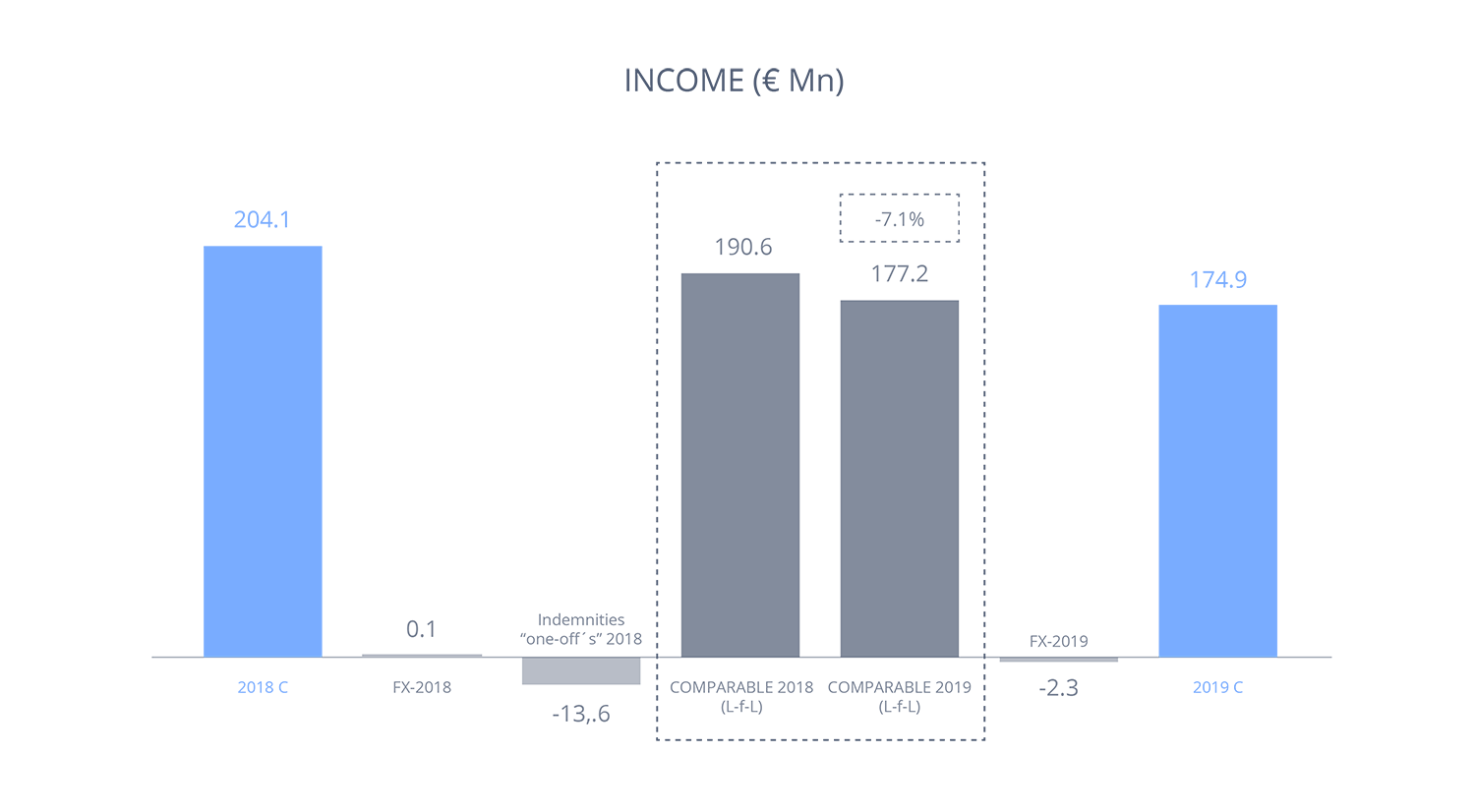

In 2019 the same commercial dynamics of previous years, which are suffering from the complex situation in the sector, have been maintained, with the result of a significant decrease in total income to €174.9 million, compared to the €204.1 million earned during the previous year.

These figures have not only been affected by the decrease in revenue from space capacity as a result of issues in the market, but also by effects not directly related to business activity. It has therefore been necessary to make adjustments in order to obtain a faithful view that is comparable to the annual evolution of Hispasat’s business, given that 2018 income included extraordinary non-recurring items corresponding to contractual considerations as a result of the delay in commissioning some satellites.

Adjusting this effect and using a constant exchange rate, comparable income would be €177.2 million and €190.6 million for 2019 and 2018 respectively, which represents a reduction of -7.1%, primarily caused by the marked drops in space capacity prices.

From the total consolidated revenue in 2019, €173.7 million correspond to income from leasing and providing space capacity services, €67.4 million of which were generated by the satellites located in the orbital positions marketed by the parent company: 30ºW, 36ºW and 55ºW. The orbital positions in Brazil, 61º, 70ºW and 74ºW, recorded an income of €106.3 million.

SPACE CAPACITY INCOME

SPACE CAPACITY INCOME BY SERVICE TYPE

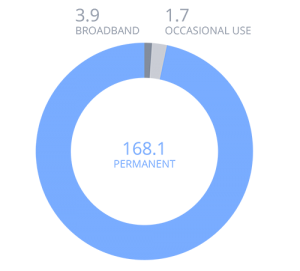

During the 2019 business year, permanent space capacity revenue was €168.1 million. The broadband business line generated €3.9 million. For occasional use, revenue reached €1.7 million.

SPACE CAPACITY INCOME BY GEOGRAPHICAL AREA

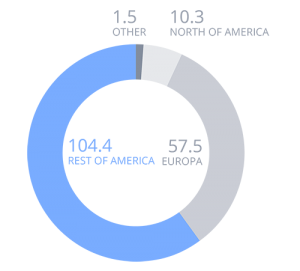

By geographical area, 33.9% of the company’s space capacity leasing income comes from Europe and other regions, whilst 66.1% originates from the American market, a region that HISPASAT has firmly committed to during recent years and where it has reached a consolidated position.

The commercial effort is reflected in the fact that the company’s portfolio of satellite capacity contracts (back-log) at the end of 2019 continues to be one of the highest in the industry and represents 4.8 times HISPASAT’s annual revenue.

CONSOLIDATED OPERATING AND EBITDA COSTS

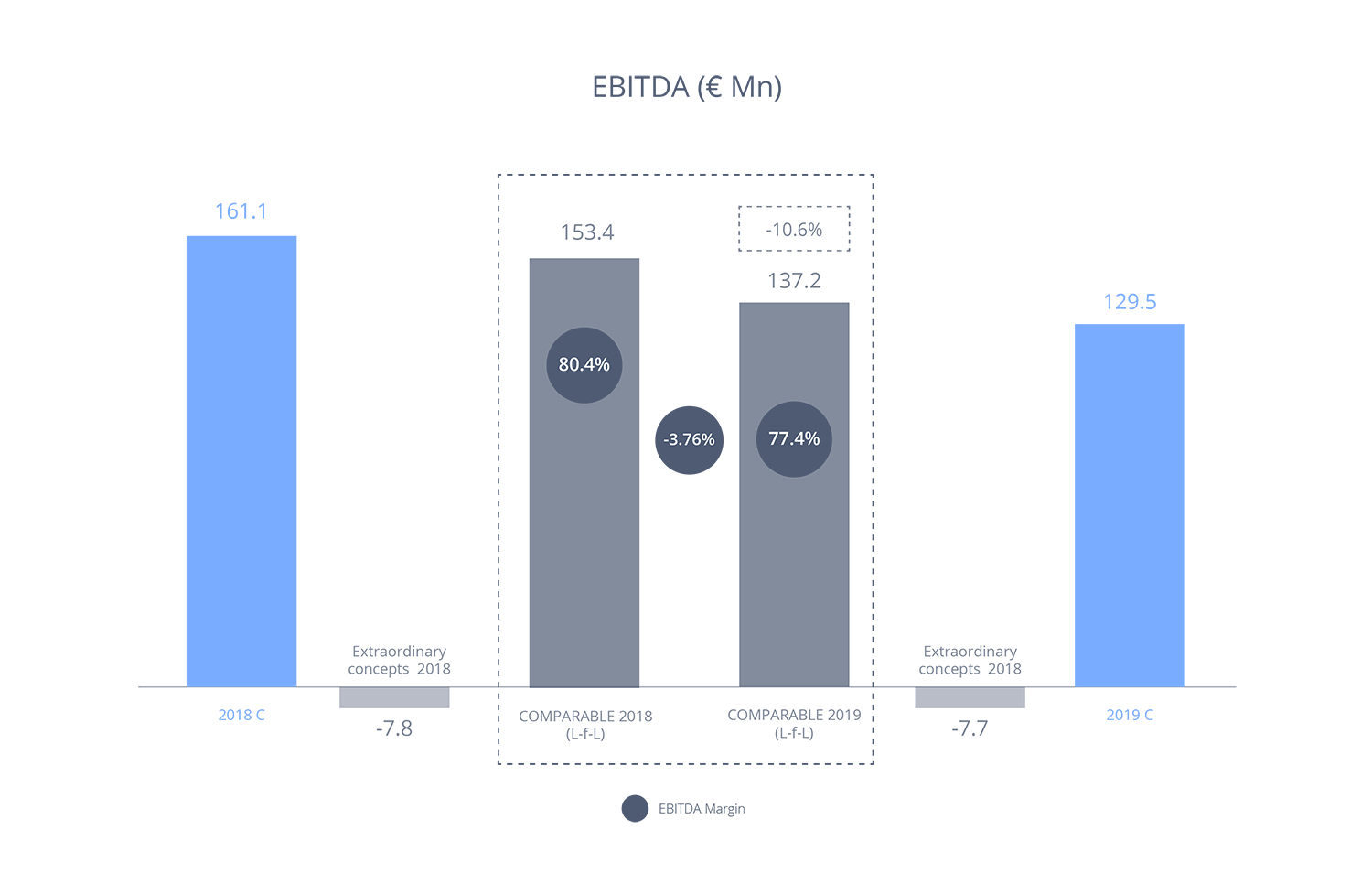

EBITDA reached €129.5 million, 10.6% lower than the previous year, also in comparable terms. This after adjusting the non-recurring extraordinary expenses incurred in 2019 in renewing the administrative and management bodies of the company after the shareholder restructuring that took place in October 2019, as well as the provisions for the write-off of the commercial portfolio, mainly in Mexico, due to the increased risk of recoverability of certain customer balances.

The cost of insurance has also increased due to there being more insured capital because of having incorporated new satellites into fleet insurance, and due to the increase in applicable rates, caused by the high accident rate in recent months in the sector as a whole.

The comparable EBITDA would be €137.2 million and €153.3 million for 2019 and 2018 (-10.6%) and, even so, the EBITDA margin was 74.1% (77.4% adjusting extraordinary effects), in line with that of the largest operators in the industry.

EVOLUTION OF CONSOLIDATED RESULTS

At the end of the 2019 financial year, HISPASAT had a consolidated operating profit of €13.4 million, which was significantly affected, in addition to the extraordinary effects previously mentioned in relation to consolidated EBITDA, by the significant increase in amortizations by €11.7 million compared to 2018, due to the effect produced by the H30W-6 satellite coming into operation in June of that year, meaning that it only amortised during the second half.

Regarding the consolidated financial result, at the end of 2019 it stood at -€14.5 million, taking into account the divestment of a financial participation in a satellite constellation project that yielded a loss of €4.9 million.

The consolidated company result by equity method obtained a positive result of €4 million.

Finally, and as a result of all the above, in this financial year HISPASAT earned a consolidated net profit attributed to the parent company of €0.45 million. In comparable terms, adjusting these and other extraordinary effects both in 2019 and 2018, the result of the year would have been €6.9 million.

GROSS OPERATING CASH FLOW

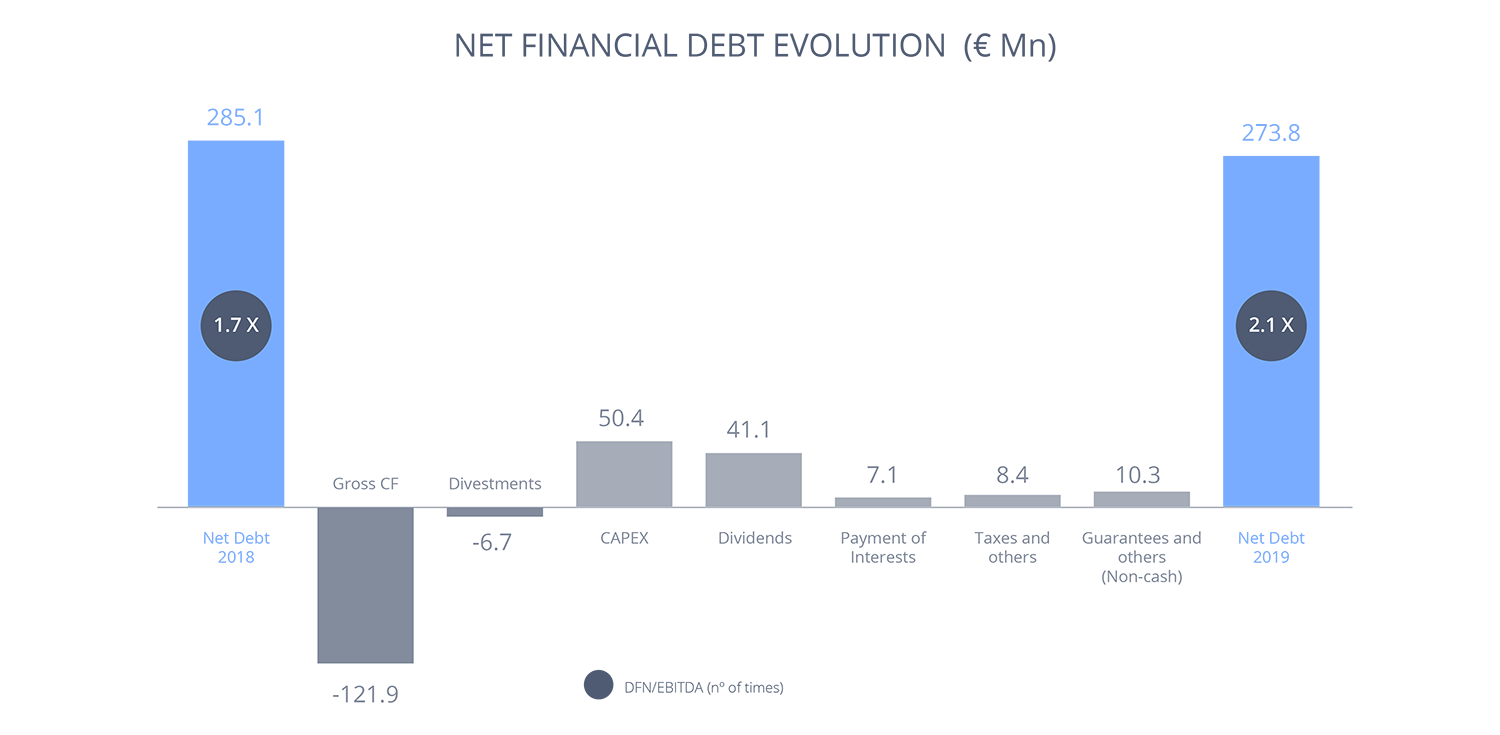

Despite the unfavourable environment, the company continues to generate recurring operating cash flow well above its annual structured debt maturities, which in 2019 were €75 million. The gross operating cash flow (before interest and taxes) for the financial year was €121.9 million, which has reduced net debt to €273.8 million from €285.1 million at 31 December 2018.

Likewise, during the year the company received €6.7 million in insurance compensation relating to the incident that occurred at the end of 2018 with the H74W-1 satellite (previously known as Amazonas 4).

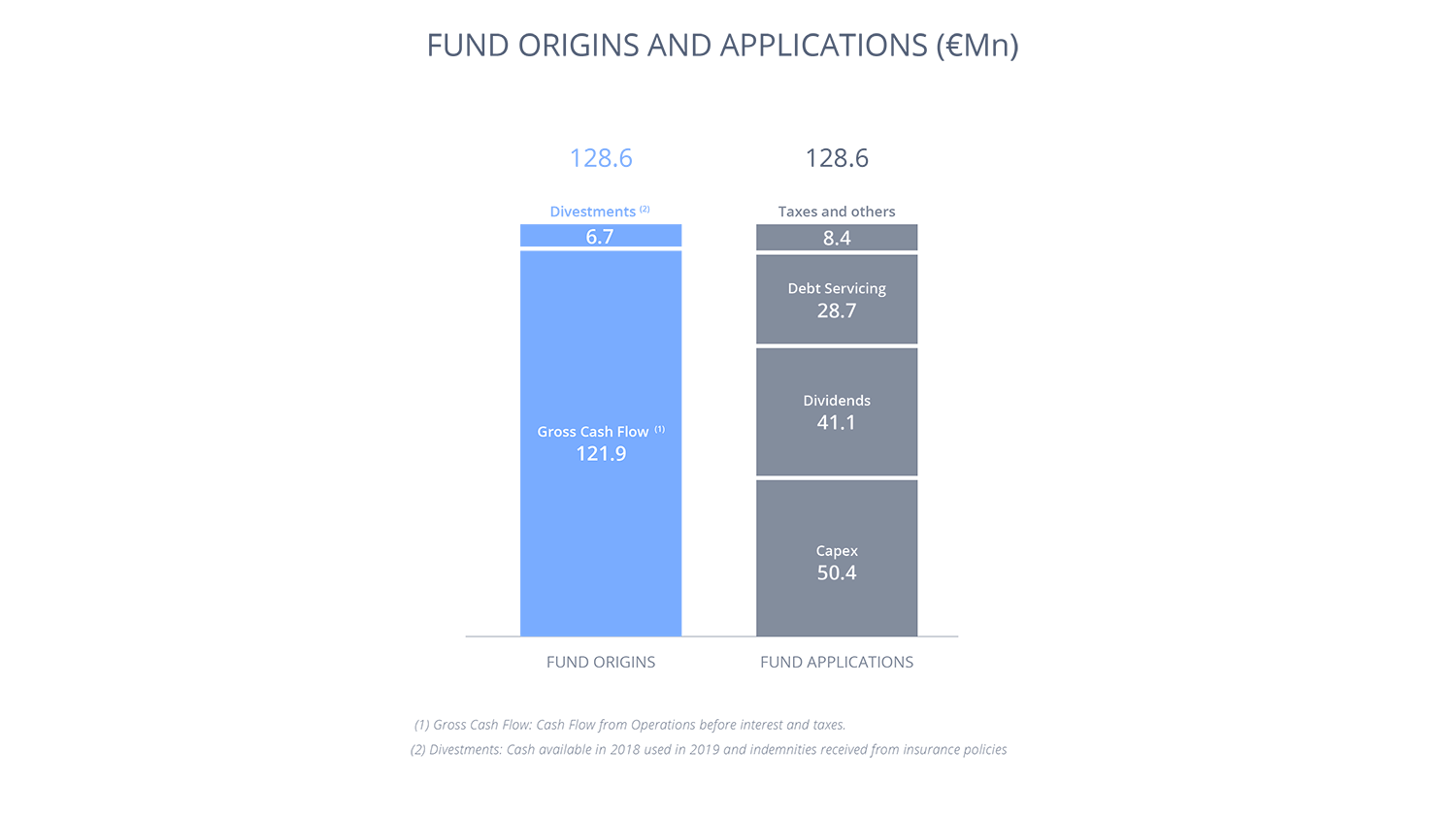

In total, the cash resources generated during the year totalled €128.6 million, which were used as follows:

- €50.4 million to investment payments for the acquisition of tangible and intangible fixed assets.

- With regard to debt servicing and financing activities, it is worth mentioning that in 2019 structured bank debt maturities amounting to €75 million were attended, and net movements (€117 million in provisions less €76.4 million in reimbursements) produced during the year from the “revolving” credit line resulted in a net disposition of €40.6 million, from which should be deducted the reduction of the balances of cash and equivalents in 2019 for an amount of €12.8 million. Interest payments amounted to €7.1 million and the average interest rate for debt in the financial year was 2.1%, excluding fees and debt formalisation costs.

- In addition, in 2019 dividend payments were made, with a charge to the results of the previous year, in the amount of €41.1 million, a figure significantly higher than the €16.1 million distributed the previous year.

- The remaining cash applications, amounting to €8.4 million, correspond to tax payments and other items.

NET FINANCIAL DEBT

As of 31 December 2019, net debt, including guarantees granted to third parties, amounted to €273.8 million (€285.1 million at the end of the previous year). The leverage ratio at the end of 2019, understood as the relative proportion of the Net Financial Debt over the aggregate of Net Financial Debt of the balance sheet (including derivatives and guarantees) plus Net Equity, stands at a moderate 26%, and the ratio of Net Financial Debt over EBITDA, at 2.1 times. These figures make HISPASAT among the least leveraged companies in the sector.

The evolution of net financial debt during this year is shown in the following chart:

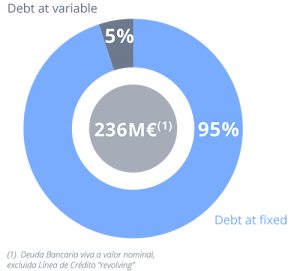

During the 2019 financial year, the average interest rate of the company’s bank debt was 2.1%, an improvement on the average interest rate of 2.2% registered in 2018 (excluding fees and debt formalisation expenses). Of the total financial debt, at the end of the year, €45 million correspond to the disposed part of the “revolving” credit line, the undrawn amount being €122 million.

Considering the interest rate and including the effect of hedging transactions through financial derivatives, 95% of HISPASAT’s structured debt is at a fixed rate, and the remaining 5% is at a variable rate.

Regarding the capital structure, HISPASAT follows a policy of ensuring a financial structure that optimises the cost of balanced capital with a solid financial position, making the creation of shareholder value compatible with achieving a competitive cost for financing needs.

INVESTMENT

Investments in tangible and intangible fixed assets during 2019 amounted to €43.7 million compared to €57.2 million the previous year, as a result of having completed the satellite programmes that culminated in the launch of the H30W-6 in 2018.

Of the investments made this year, 78.2% correspond to the company’s new satellite mission, Amazonas Nexus, and includes both the first payment to the satellite manufacturer and the investment in regulatory rights for its commissioning in 2023. Investments in broadband platforms in line with orientating the business towards providing managed services with greater added value, as well as other actions aimed at renewing the systems and modernising the control infrastructures that HISPASAT has at Arganda del Rey (Madrid) and Serviente (Rio de Janeiro), accounted for another 11.5% of the investment effort.

© Informe Anual Hispasat 2018

Paseo de la Castellana, 39 28046 Madrid Spain

+34 91 710 25 40