KEY DATA

| HISPASAT (millions of euros) | 2016 | 2017 | 2018 |

|---|---|---|---|

| Operating revenue | 228,9 | 235,1 | 204,1 |

| EBITDA | 175,6 | 192,1 | 161,1 |

| Pre-tax profit | 50,8 | 97,1 | 45,0 |

| Net profit | 25,1 | 80,5 | 41,1 |

| Total assets | 1.270,1 | 1.302,9 | 1.238,2 |

| Equity | 742,8 | 818,4 | 842,6 |

| EBITDA Margin | 76,7% | 81,7% | 78,9% |

| Net debt/EBITDA | 2,2 | 1,9 | 1,8 |

ECONOMIC-FINANCIAL RESULTS

OPERATING REVENUE

In the 2018 financial year, HISPASAT earned an income of €204.1 million. This amount is 13.2% less than that recorded in 2017. From the total of the aforementioned consolidated revenue, €192.5 million correspond to income from leasing and the provision of space capacity services, €56.7 million of which were generated by the 30º West orbital position. Orbital position 61º West posted revenue of €118.2 million, while the other orbital positions account for the rest.

CONSOLIDATED OPERATING AND EBITDA COSTS

Operating expenses for 2018 came to €43 million.

In 2018, the company continued to drive actions aimed at improving its operating efficiency, adapting its operational structure and their costs to the needs of new satellite projects. The aforementioned policies aim to improve HISPASAT competitiveness in Europe, America and other regions considered to be strategic objectives in the near future.

Of the evolution described in the previous sections, at the end of 2018 the EBITDA were €161.1 million, which represents an operating margin of 78.9%.

REVENUE FROM SPACE CAPACITY

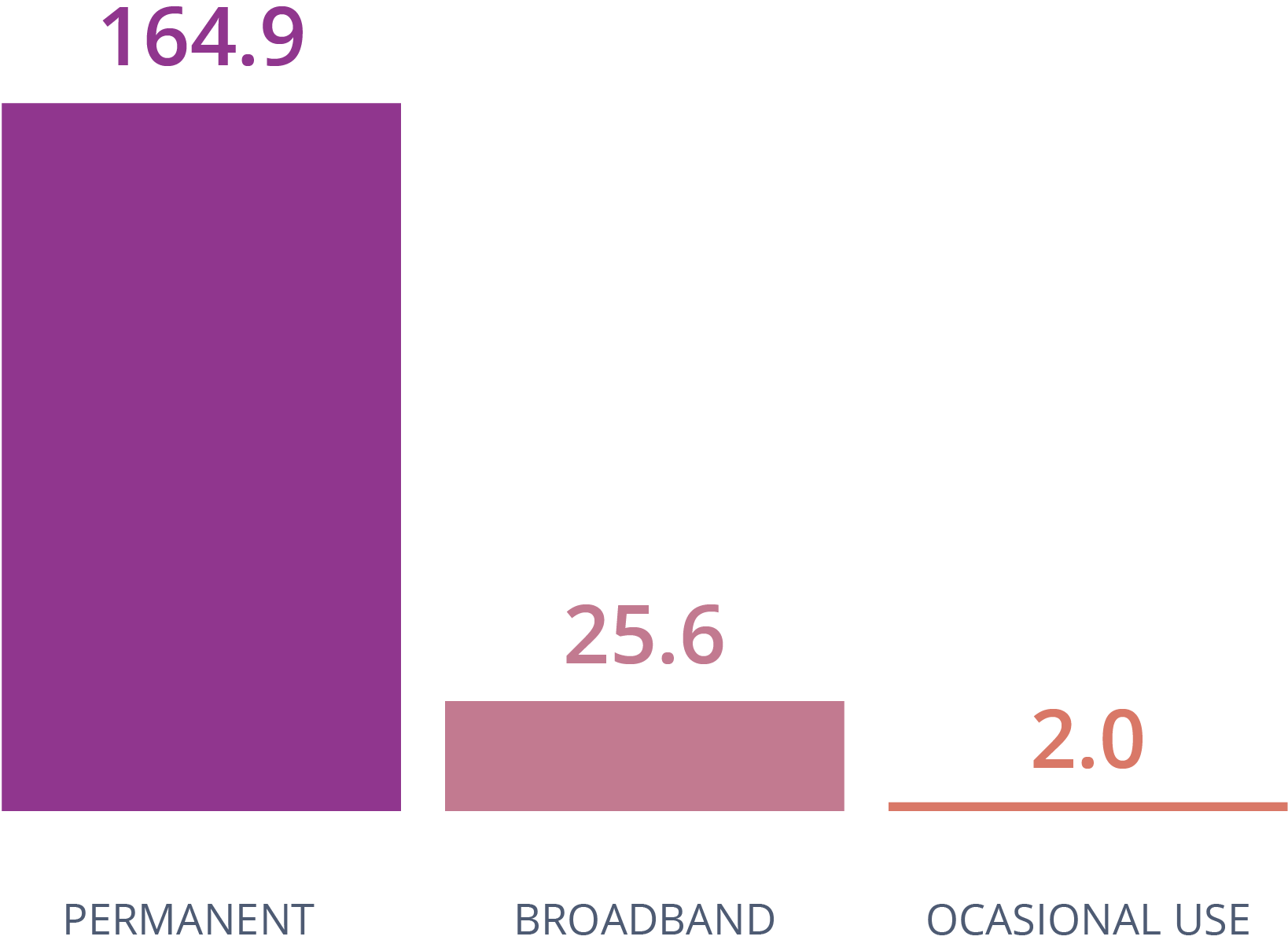

BREAKDOWN BY SERVICE TYPE

(in millions of euros)

During the 2018 business year, permanent space capacity revenue was €164.9 million. The broadband business line generated €25.6 million. For Occasional Use, revenue reached €2 million.

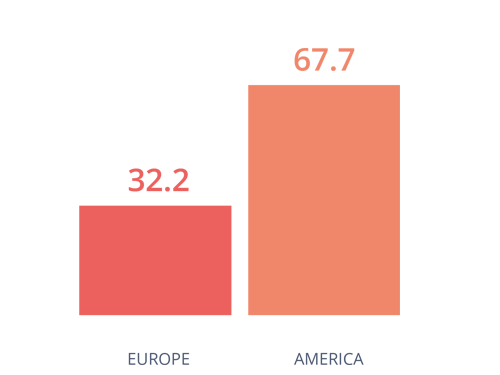

BREAKDOWN BY GEOGRAPHICAL AREA

(in millions of euros)

By geographical area, 32.2% of total revenue from leasing Group space capacity comes from Europe, 67.7% comes from the American market and the remainder comes from other regions.

EVOLUTION OF RESULTS

By the end of the 2018 business year, HISPASAT had obtained an operating profit of €56.8 million. This is 48.75% down on the previous financial year, due to the repayments throughout the year for the Hispasat 36W-1 and Amazonas 5 satellites, which were launched in 2017, and those corresponding to the Hispasat 30W-6 satellite, launched in March 2018.

Taking into account the result given by the equity method for the company’s share in HISDESAT, the consolidated negative financial result was €(10.8) million.

The consolidated result before tax amounted to €46 million.

As a result, in the 2018 financial year, HISPASAT recorded a net profit attributed to the parent company of €41 million. This is significantly lower than that registered at the close of the previous year, and this is due to the decrease in EBITDA and the increase of repayments and financial costs attributed to the new satellites launched in 2017 and 2018.

DIVIDEND

On 4th February 2019, the HISPASAT, S.A. Board of Directors drew up the annual consolidated accounts for the HISPASAT Group and the individual accounts of HISPASAT, S.A., proposing to distribute as dividends 50% of the consolidated net profit attributed to the parent company, which amounts to €20,540,711. This amount should be distributed from the Group’s parent company, HISPASAT, S.A. Taking into account that the result obtained by HISPASAT, S.A. for the 2018 financial year amounts to a value of €13,922,432, of which it is proposed to provide the capitalisation reserve, in accordance with Article 25 of the Company Tax Law, an amount of €2,979,988. The proposed amount for distribution as ordinary dividend for the financial year would be €10,942,444, which would be complemented with a distribution of voluntary reserves from the parent company via extraordinary dividend amounting to €9,598,267.

In addition to and independently of the above, the Board of the parent company also proposed to the relevant Shareholders’ Meeting of the parent company, the distribution of an additional extraordinary dividend via a distribution of parent company voluntary reserves for the amount of €20,540,710.

Both proposals amount to a total distribution of €41,081,421, which corresponds to the consolidated net result attributed to the parent company for the 2018 financial year. This dividend was approved by the HISPASAT, S.A. Shareholders’ Meeting, which was held on 7th March 2019.

FINANCIAL STRUCTURE AND CASH FLOW

The operating cash flow generated by the Hispasat Group in 2018 stood at €160.6 million, increasing in relation to the previous year due to the return of payments on account of corporation tax of the Spanish Tax Group for 2017 and 2018, and higher incoming payments from customers compared to the previous year. These flows have primarily been used to finance the Group’s investment activities.

Cash flow from fixed asset investments (tangible and intangible) increased to €61.9 million, mostly made up of payments in the financial year of the remaining milestones of the investments associated with the Amazonas 5, Hispasat 30W-6 and Hispasat 36W-1 projects, and the payments on broadband platforms for the development of Managed Services.

In the chapter about cash flow within financial activities, it is worth mentioning that bank debt maturities amounting to €157.2 million have been covered, including the early cancellation of the syndicated loan for H36W-1, and provisions have been made for €83.9 million of new financing.

Likewise, dividend payments of €16.1 million were made.

INVESTMENT

Investments in tangible and intangible fixed assets reached €57.2 million, compared to €115.1 million for the 2017 business year. investment in 2018 comes from the latest milestones for the manufacture and launch of the Hispasat 30W-6 satellite, put into operation on 26th June 2018, the initial payment of the Amazonas 6 satellite launcher and investments in online broadband platforms, with the business being oriented towards the provision of higher added value managed services.

Paseo de la Castellana, 39 28046 Madrid Spain

+34 91 710 25 40

© Informe Anual Hispasat 2018

Legal Notice

Cookies