ECONOMIC-FINANCIAL RESULTS

In 2016, HISPASAT continued to carry out its activities in the framework set forth by the main strategic lines that focus on growth. In this line, considerable work has been done to enter into new markets such as Morocco, establish partnerships with other operators, and renew and extend contracts with important clients, especially those in Latin American countries such as Brazil, Peru, Mexico and Colombia.

The commercial e orts made have also led to the consolidation of signi cant backlog (guaranteed long-term satellite capacity contracts), which reached a gure equivalent to 6.5 times the company’s annual revenue at the end of the nancial year.

OPERATING REVENUE

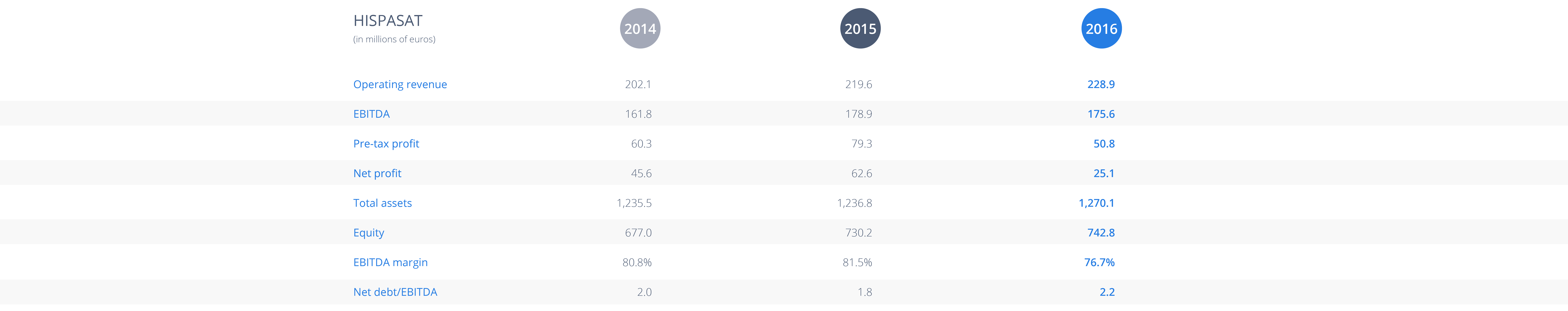

In 2016, total revenue earned reached 228.9 million euros, which amounts to an increase of 4.2% with respect to the previous year. 222.5 million euros of the total revenue came from leasing space capacity, 4.2% more with respect to the previous year.

REVENUE FROM SPACE CAPACITY

BREAKDOWN BY SERVICE TYPE (in millions of euros)

During the 2016 business year, permanent space capacity revenue was 208.5 million euros. The broadband business line generated 14.6 million euros. For occasional use, revenue reached 2.4 million euros.

EVOLUTION OF OPERATING AND EBITDA EXPENSES (in millions of euros)

By geographic area, 34.5% of total revenue from leasing space capacity comes from Europe, 64.6% comes from the North and South American market and the remaining 0.9% from other regions.

EVOLUTION OF OPERATING AND EBITDA EXPENSES

Operating expenses for 2016 came to 53.2 million euros, 30.7% more with respect to the previous year. .

In 2016, the company incurred non-recurring operating costs of 10.1 million euros, for the contracting of space capacity in order to advance the provision of services from 36o West before the launching of Hispasat 36W-1. In comparison with 2015, recurring operating costs in 2016 increased by 6.1%.

Of the evolution described in the previous sections, at the end of 2016 the EBITDA were 175.6 million euros, which represents an operating margin of 76.7%.

If the company had not incurred these costs, the EBITDA at the end of 2016 would have been 185.8 million euros with an operating margin of 81.2%, in line with the previous year.

EVOLUTION OF RESULTS

By the end of the 2016 business year, HISPASAT had obtained an operating pro t of 101.5 million euros.

Taking into account the result given by the equity method for the company’s share in HISDESAT, the consolidated negative nancial result was (47.6) million euros.

After the nancial result and the results of associated companies consolidated by the equity method, the consolidated pre-tax result reached 50.8 million euros.

Likewise, in the 2016 business year, HISPASAT registered a net pro t at the parent company of 25.1 million euros, below the 62.2 million euros obtained at the end of the previous business year, due mainly to the adverse situation of HISDESAT, as well as to the extraordinary expenses mentioned.

DIVIDEND

On 15 February 2017, the Board of Directors formulated the consolidated annual accounts for the Group, and the individual accounts for HISPASAT, S.A. They include a proposal for dividend distribution of 5 million euros, awaiting approval at the Annual General Shareholders’ Meeting.

FINANCIAL STRUCTURE AND CASH FLOW

As of 31 December 2016, bank debt had increased to 367.3 million euros.

Operating cash ow generated by HISPASAT in 2016 reached 125.9 million euros, mainly used to nance the company’s investment activities.

Cash ow from xed asset investments (tangible and intangible) increased to 175.8 million euros, mainly from payments from investments associated with the Amazonas 5, Hispasat 30W-6 and Hispasat 36W-1 projects.

In the area of cash ow from nancial activities, it is worth mentioning that 83.9 million euros of bank debt reached maturity, while 101.1 million euros were made available for new nancing, without taking into account for these amounts the provisions of the revolving loan granted to the dominant rm, paid o in the same year, an amount reaching 30 million euros.

Likewise, dividend payments of 12.5 million euros were made.

INVESTMEN

Investments in tangible and intangible xed assets increased to 167.8 million euros in comparison to 245.1 million euros from the 2015 business year. It has completed the strong investment rate of the previous business years, although with a reduction in the total due to the completion of several projects of the Growth Plan and delays in some ongoing missions, which have deferred part of the investment to the following year

The Hispasat 36W-1 programme continued in 2016, as well as the two satellite projects – Amazonas 5 and Hispasat 30W-6 – which began in the previous business year.

During the 2016 business year, HISPASAT was involved in di erent R&D initiatives that promoted the development of new solutions and services in the eld of satellite communications, which once again re ects the company’s innovative spirit and its commitment to quality and excellence.